What is PTRC challan?

How to download PTRC challan is given below. PTRC stands for Professional Tax Registration Certificate, and a PTRC challan is a document used to pay professional tax in certain Indian states. Professional tax is a tax levied by state governments on income earned by individuals or organizations engaged in professions, trades, callings, or employments.

The PTRC challan is a document that contains the details of the amount of professional tax that needs to be paid, the name and address of the taxpayer, and the bank account details of the government. The challan is used to make the payment of professional tax to the designated bank or government office. After the payment is made, the taxpayer receives a receipt that serves as proof of payment.

It is important to note that the rules and regulations regarding professional tax, including the requirement for a PTRC challan, can vary from state to state in India. Therefore, it is advisable to check the rules and regulations in the state where you are liable to pay professional tax to ensure that you comply with all the relevant requirements.

How to download PTRC challan? You can follow these steps:

To download the PTRC challan, you can follow these steps:

- Go to the official website of the Commercial Taxes Department of your state. For example, for the state of Punjab, the website is https://www.pextax.com/.

- Look for the “Downloads” or “Forms” section on the website.

- In the Downloads or Forms section, look for the PTRC challan.

- Once you find the PTRC challan, click on the download link to save the form to your computer.

- After downloading the PTRC challan form, take a printout of the form.

- Fill in the necessary details in the form, such as your name, address, PAN number, assessment year, etc.

- Calculate the tax amount that you need to pay and fill in that amount in the form.

- Submit the form along with the payment at the designated bank or through online mode, as per the instructions provided on the form or on the website.

It is important to note that the exact steps to download the PTRC challan may vary depending on the state in which you are located. Therefore, it is recommended to visit the official website of the Commercial Taxes Department of your state and follow the instructions provided there.

People also ask for:

How can I download professional tax paid challan in Maharashtra?

Here are the general steps to download a professional tax paid challan in Maharashtra:

- Visit the official website of the Maharashtra government’s Department of Sales Tax or Commercial Taxes.

- Look for the option to download challans or forms related to professional tax payments.

- Enter the required details such as the professional tax registration number, name, and address.

- Choose the mode of payment and enter the amount paid.

- Generate the challan and download it in PDF format.

- Print the challan for your records and for future reference.

It is important to note that professional tax paid challans are specific to the state or region you are in. Therefore, it is recommended to visit the website of the concerned department or seek assistance from a tax professional to ensure that you download the correct challan.

How do I verify my PT payment in Maharashtra?

Here are some general steps you can take to verify your PT payment in Maharashtra:

- Visit the official website of the Maharashtra government’s revenue department.

- Look for the option to verify your payment status. It may be under the “Online Services” or “Payment” section of the website.

- Enter the required information such as your PT registration number, bank account details, and payment reference number.

- Submit the information and wait for the system to verify your payment status.

- If your payment is verified, you will receive a confirmation message or receipt. If there is an issue with your payment, the system will provide you with details on how to rectify the problem.

Alternatively, you can also contact the Maharashtra government’s revenue department or your local PT office for assistance in verifying your payment status.

How can I get PT Challan in Telangana?

I can provide general information on how to get PT Challan in Telangana.

- Visit the official website of Telangana State Road Transport Corporation (TSRTC) – https://www.tsrtconline.in/.

- Click on the “Other Services” tab and select “PT Challan” from the drop-down menu.

- Enter the vehicle number and select the “Challan Generation” option.

- The PT Challan will be generated and displayed on the screen.

- Pay the PT Challan fee through online modes or visit the nearest TSRTC office to pay in person.

Alternatively, you can also generate PT Challan through the Telangana Transport Department website – https://transport.telangana.gov.in/ptregistration.do.

Please note that the process may vary depending on the authority and rules of the respective department.

How can I pay my PTRC online in Maharashtra?

To pay your Professional Tax Registration Certificate (PTRC) online in Maharashtra, you can follow these steps:

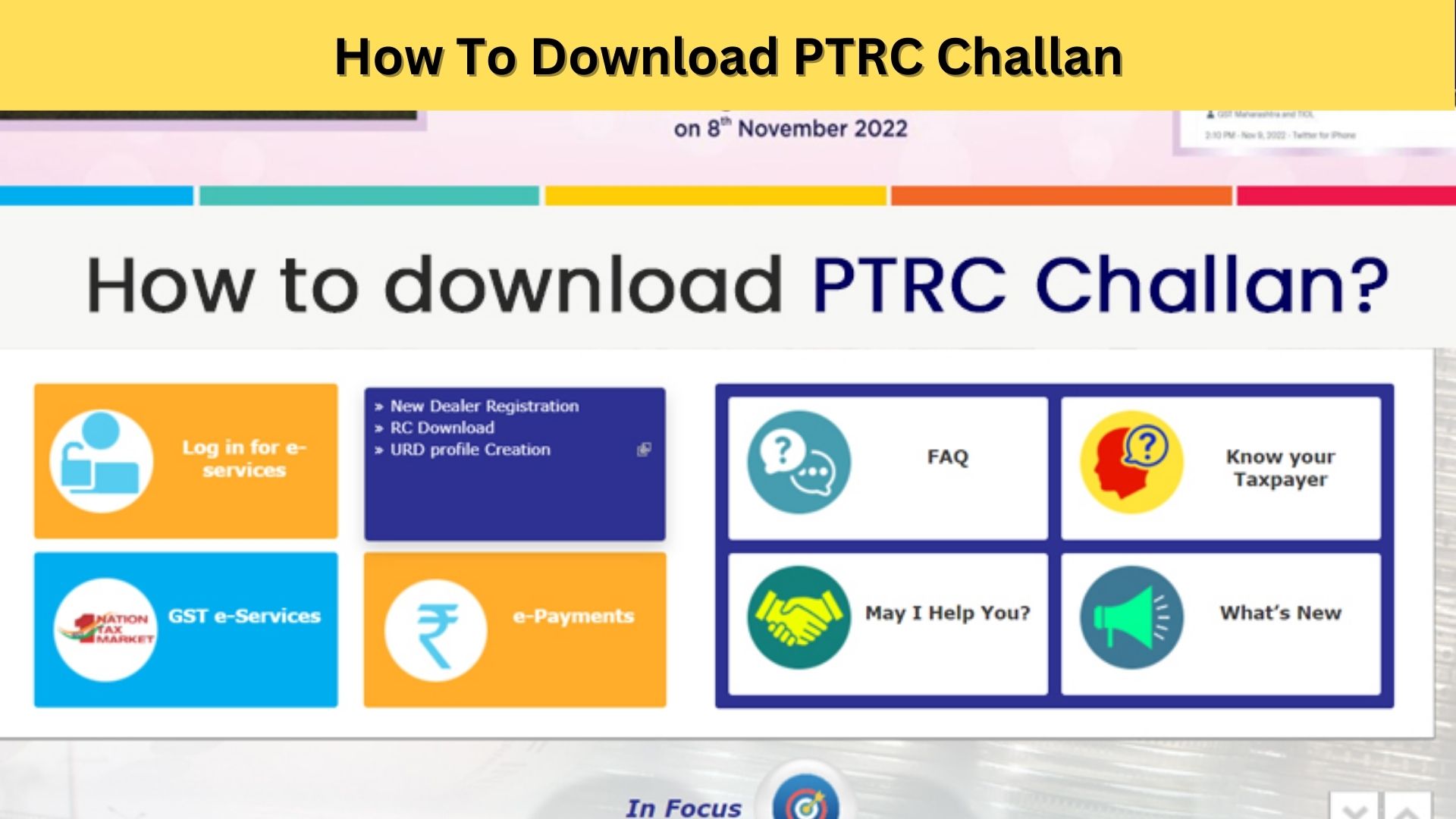

- Visit the Maharashtra Government’s official website for e-services: https://www.mahagst.gov.in/

- Click on the “e-Payment” tab on the homepage.

- Select “Professional Tax” from the dropdown menu.

- Enter your PTRC number in the relevant field.

- Fill in the required details, such as your name, address, email ID, and contact number.

- Choose the bank through which you want to make the payment.

- Confirm the details you have entered and proceed to make the payment.

- Once the payment is successful, you will receive an acknowledgement receipt.

Note: Make sure you have a valid bank account with sufficient balance to complete the transaction. Also, ensure that you are using a secure internet connection when making the payment.

Can I get professional tax receipt online?

Many organizations offer the option to download and print tax receipts online. You can check with the organization or company from which you are seeking a tax receipt to see if this option is available. Additionally, the IRS provides guidance on acceptable documentation for claiming tax deductions on their website.

How do I get my professional tax receipt?

Here are some steps that you can follow to get your professional tax receipt:

- Determine the agency that issues the professional tax receipt. Depending on your country or state, the agency could be the tax department, municipal corporation, or local authority.

- Contact the agency and ask them how to obtain your professional tax receipt. Some agencies may have an online system where you can download your tax receipt, while others may require you to visit their office in person.

- Provide the necessary information to the agency. You may need to provide your tax ID number or other identifying information to get your professional tax receipt.

- Pay any outstanding taxes or fees before you can receive your receipt. In some cases, you may need to pay any outstanding taxes or fees before the agency will issue your receipt.

- Once you have obtained your professional tax receipt, keep it in a safe place for future reference. You may need it for tax filing purposes or for other professional requirements.

How do I download tax paid receipt in parivahan?

to download a tax paid receipt in Parivahan, you may follow these general steps:

- Visit the Parivahan website (https://parivahan.gov.in/).

- Click on the “Online Services” tab and select “Know Your Vehicle Details” from the drop-down menu.

- Enter your vehicle registration number and click on the “Search Vehicle” button.

- Click on the “Tax Details” tab to view your tax payment history.

- Select the tax payment receipt that you want to download and click on the “Download Receipt” button.

- Save or print the downloaded receipt for your records.

Note: The steps may vary depending on the state in which the vehicle is registered. Please refer to the Parivahan website for state-specific information.

How do I download an e file receipt?

you can generally follow these steps to download an e-file receipt:

- Log in to your account on the platform where you filed your taxes or made a payment.

- Find the section of the platform that contains your payment or filing history.

- Look for the specific transaction for which you need the receipt.

- Click on the transaction to open it and see the details.

- Look for a “Download Receipt” or similar option and click it.

- Save the receipt to your computer or mobile device.

If you are having trouble finding the receipt or downloading it, check the platform’s help section or contact their customer support for assistance.

What is the full form of PTRC?

The full form of PTRC is Professional Tax Registration Certificate.

How do I get a local business tax receipt?

- Determine your business location: Check the local government website to see if your business is located in an unincorporated area or a municipality. You will need to apply for a local business tax receipt with the appropriate jurisdiction.

- Obtain a business tax receipt application: Download or obtain an application form from the local government website or visit the city hall to get one.

- Fill out the application: Complete the application form with all the required information, such as the type of business, location, and contact information.

- Submit the application: Submit the application along with the required documents and fees to the local government office. The required documents and fees may vary based on the location and type of business.

- Wait for approval: The local government office will review your application and issue a local business tax receipt upon approval.

- Renew your tax receipt: Local business tax receipts are typically renewed annually, and you will need to renew your tax receipt each year to remain in compliance with local regulations.